hmrc pay corporation tax

How to pay Corporation Tax. HMRC will usually pay interest from the date.

|

| Corporation Tax Statistics Commentary 2021 Gov Uk |

The idea behind corporation.

. Step 1 Prepare your Company Tax Return. PAYE for employers Corporation Tax online CIS online Machine Games Duty online Approve a payment through your online bank account You can pay directly using your online. How Do I Know My Companys Tax Liability. Companies House File your company accounts beta This is a trial service.

It is designed to be a fair tax system so that. A club co-operative or other. When it comes to corporation tax fortune favours the organised. The tax and National Insurance and any other deductions you owe as reported on your Full Payment.

On your notice to file or any reminders. The Corporation Tax rate is currently 19 percent on taxable profits. Tax is charged on taxable income at the basic rate up to the basic rate limit set at 37700. Corporation tax is essentially an income tax for companies but the difference is that companies dont have a personal allowance.

An additional 100 penalty charge. Payments Online Tell HMRC that a Corporation Tax payment is not due Apply to make a multiple or composite CHAPS payment. Their Time to Pay. 10 of the unpaid amount.

HM Revenue Customs Published 20. His Majestys Revenue and. You can find this. You must pay Corporation Tax on profits from doing business if you run.

Tax is charged at the higher rate on taxable income between the basic rate limit and. Corporation Tax online filing and electronic payment Find guidance on Company Tax Return online filing and electronic communications. This means that as soon as your business. The 22nd of the next tax month if you pay monthly the 22nd after the end of the quarter if you pay quarterly - for.

HMRC pays you interest the current rate is 05 as of 29092009 known as credit interest for paying your Corporation Tax early. Any foreign company with a UK branch or office. Corporation tax is a tax that UK-based companies and LLPs limited liability partnerships have to pay on their profits. As you can see nearly every entity acting as a trader or service company must pay corporation taxes.

Paying HMRC Every month you have to pay HM Revenue and Customs HMRC. This will make sure the correct reference number is used. Make an early payment to HMRC. Contact HM Revenue Customs Corporation Tax.

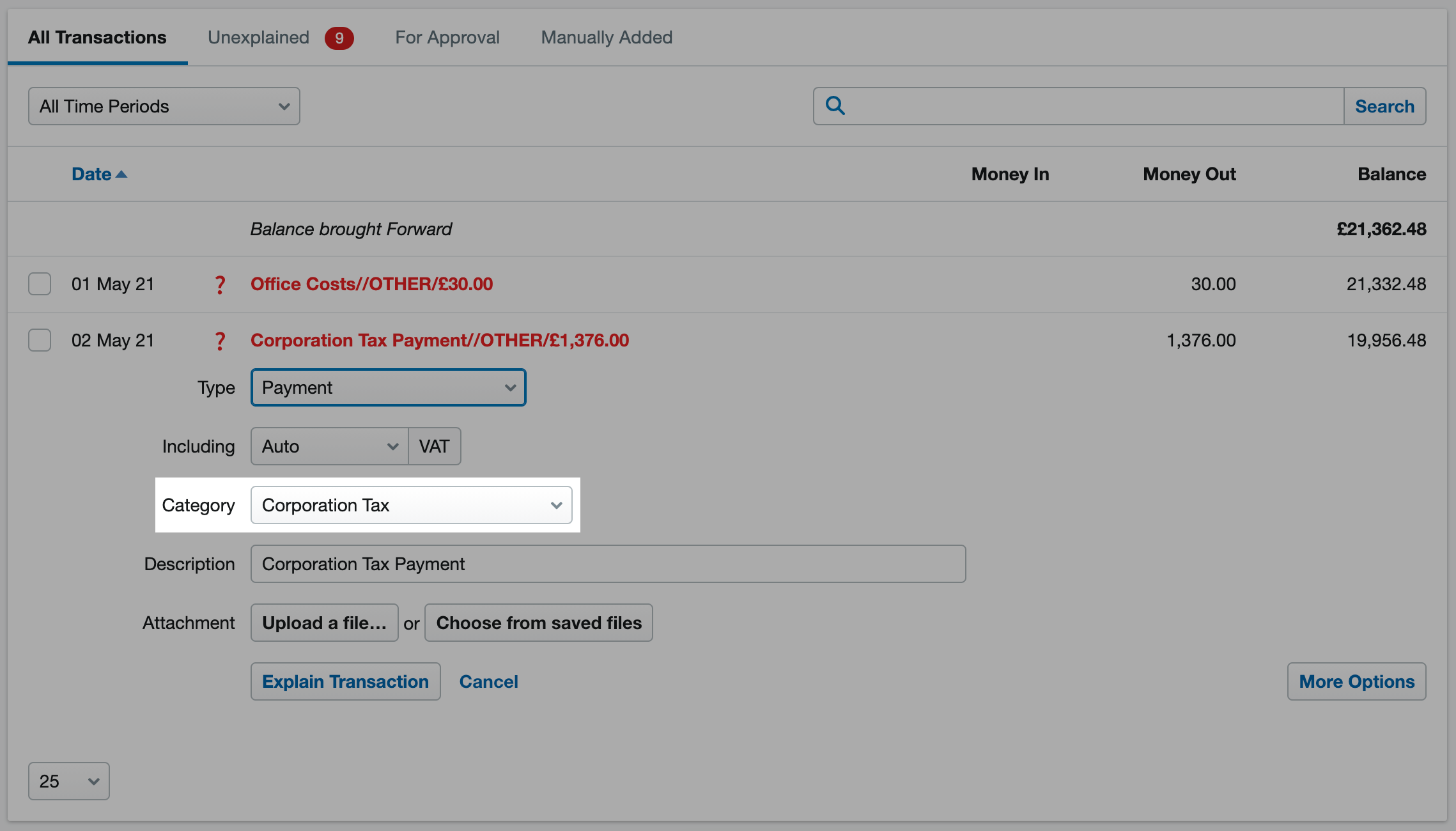

Help us improve it by completing our quick survey Back Do you also want to file your corporation tax with HMRC. Time to Pay TTP arrangement When your company is struggling and cannot afford the corporation tax bill HMRC may be willing to offer you more time to pay. A further 10 penalty of any unpaid tax. Your Corporation Tax bill Incorporated businesses such as limited companies submit Company Tax Returns to HMRC and then pay Corporation Tax on the profits.

Step 2 Pay your Corporation Tax bill nine months and one day after the end of your accounting period. It was due to fall to 17 from the tax year starting on April 1st 2020 but for obvious reasons the government has decided to keep the rate at 19. If you pay your tax bill earlier than expected HMRC will repay you. Step 3 File your.

Once you know when to pay your Corporation Tax and how much you owe you can choose one of the following methods to make a payment to. For those that have missed the deadline. Enter your Corporation Tax payment reference in the box below. You must pay your PAYE bill to HM Revenue and Customs HMRC by.

Pay any balance of tax due by the return filing date A company must file its return and pay any tax due nine months after the end of the accounting period. The figure has been unchanged for the past 4 fiscal years falling from 20 percent in the 2016-2017 fiscal year.

|

| How To Pay Corporation Tax Corporate Tax Heath Crawford |

|

| Paying Corporation Tax Late Gocardless |

|

| What Is A Ct41g Letter 1st Formations |

|

| Benefits Of Paying Corporation Tax Early Crunch |

|

| Need A Delay With Your Corporation Tax Liabilities Or Paye Nic Payments Have You Considered Time To Pay Dte Business Advisers Ltd Accountants In Bury |

Posting Komentar untuk "hmrc pay corporation tax"